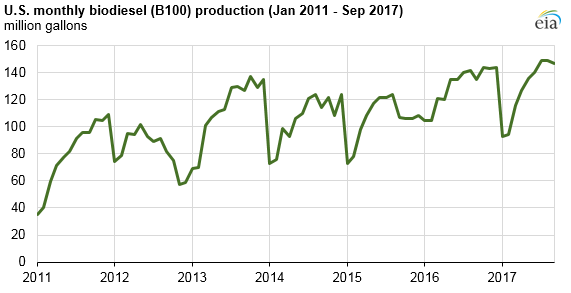

Through the first nine months of 2017, U.S. biodiesel production levels were slightly higher than 2016 levels, despite the expiration of a federal biodiesel blender’s tax credit at the end of 2016, according to an analysis by the U.S. Energy Information Administration (EIA). The EIA says domestic biodiesel production may continue to increase because of changes to import policies, such as those recently announced by the U.S. Department of Commerce (DOC) on biodiesel imports from Argentina and Indonesia.

Biodiesel production increased over time largely because of state and federal incentives. As the EIA explains, the federal biodiesel blender’s tax credit, valued at $1.00/gallon, expired several times prior to 2016, most recently at the end of 2014. In those earlier years, Congress ultimately voted to reinstate the tax credit retroactively.

Biodiesel qualifies as an advanced biofuel as part of the Renewable Fuel Standard (RFS), a program implemented by the U.S. Environmental Protection Agency (EPA) to promote the incorporation of biofuels into the nation’s fuel supply. To demonstrate compliance with the RFS, refiners and importers of petroleum products must either blend advanced biofuels such as biodiesel or buy credits called renewable identification numbers (RINs).

Biodiesel is often combined with petroleum diesel in blends ranging from 5% to 20% biodiesel. On average, the EIA says, biodiesel accounted for about 4% of total diesel consumption in 2016. Similar to corn ethanol, biodiesel production is concentrated in the Midwest and delivered by rail and truck across the country.

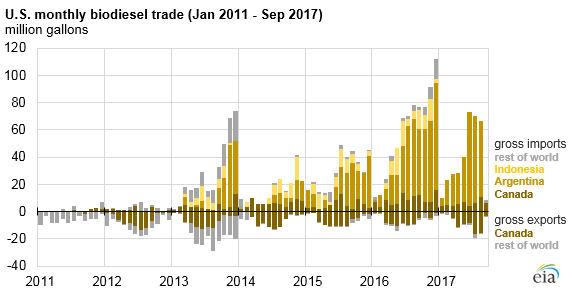

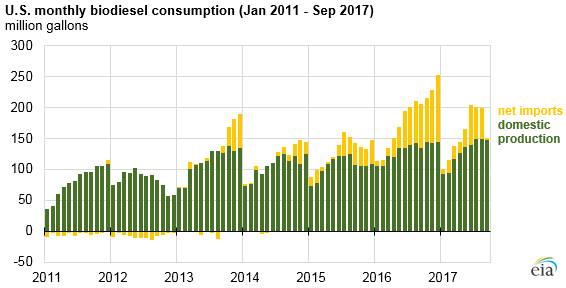

Since 2014, foreign biodiesel imports – primarily from Argentina and Indonesia – have increased in the East Coast and Gulf Coast regions. In 2016, biodiesel imports from Argentina reached 449 million gallons and accounted for nearly 20% of U.S. biodiesel consumption, according to the EIA.

However, in April 2017, the U.S. DOC initiated two investigations into whether biodiesel imports from Argentina and Indonesia put U.S. biodiesel producers at a disadvantage. The two investigations have focused on countervailing duties – when a foreign government provides subsidies for the production of a product – and antidumping – when a foreign government sells a product at less than its fair value.

In November, the DOC issued an affirmative final determination on countervailing duties for Argentina and Indonesia, assigning rates ranging from 34% to 72%, based on the producer or importer of biodiesel. The U.S. International Trade Commission reached a similar finding in December, allowing for the DOC to issue final countervailing duty orders.

Depending on the outcome of the antidumping investigation, the EIA says, the combined effect of the final orders may more than double the price of biodiesel from these two countries.

In response to the investigations, new U.S. contracts for cargos of biodiesel from Argentina and Indonesia have slowed. The EIA says imports from Argentina remained relatively high through August 2017 because of contracts that were already in place prior to the investigations, but these imports ended as of September 2017. Biodiesel imports from Indonesia last occurred in December 2016. Imports from these countries are likely to remain low unless a settlement is reached or U.S. biodiesel prices rise to offset the final duties, the EIA adds.

U.S. biodiesel consumption in 2016 totaled 2,189 million gallons, of which 1,569 million gallons (72%) were produced domestically. According to the EIA, U.S. biodiesel facilities ran at 69% of nameplate capacity during 2016. Annual production capacity at the beginning of 2016 totaled 2,270 million gallons.

U.S. biodiesel production capacity has since increased slightly to 2,348 million gallons as of September 2017, but the EIA notes the pace at which biodiesel facilities might increase production to address possible supply shortfalls from reduced imports is unclear.

According to the agency, biodiesel is typically more expensive than petroleum-based diesel, so the loss of lower-cost imports from Argentina and Indonesia might further decrease its price competitiveness. During 2016, the average spot price of Gulf Coast biodiesel was $3.17/gallon, which was $1.85/gallon higher than its petroleum counterpart, the EIA adds.