New research by Bloomberg New Energy Finance (BNEF) suggests that big reductions in battery prices lie ahead and that during the 2020s, electric vehicles (EVs) will become a more economical option than gasoline or diesel cars in most countries.

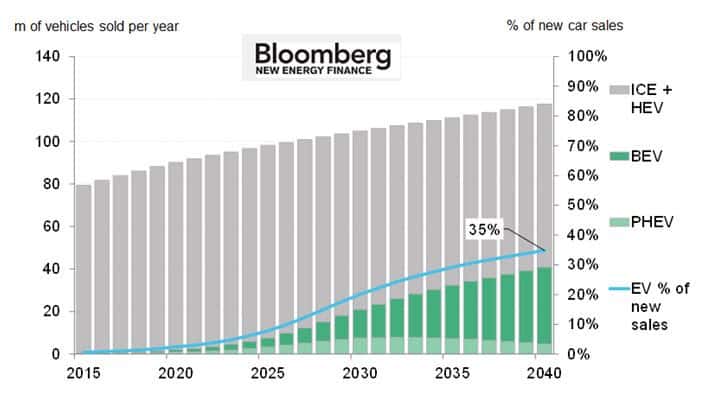

The BNEF study forecasts that sales of EVs will hit 41 million by 2040, representing 35% of new light-duty vehicle sales. This would be almost 90 times the equivalent figure for 2015, when EV sales are estimated to have been 462,000, up 60% from 2014.

The research estimates that the growth of EVs will mean they represent a quarter of the cars on the road by that date – displacing 13 million barrels of crude oil per day but using 1,900 TWh of electricity. This would be equivalent to nearly 8% of global electricity demand in 2015.

The study’s calculations on total cost of ownership show EVs becoming cheaper on an unsubsidized basis than internal combustion engine cars by the mid-2020s, even if the latter continue to improve their average mileage per gallon by 3.5% per year. It assumes that an EV with a 60 kWh battery will travel 200 miles between charges. The first generation of these long-range, mid-priced EVs is set to hit the market in the next 18 months with the launch of the Chevy Bolt and Tesla Model 3.

“At the core of this forecast is the work we have done on EV battery prices,” says Colin McKerracher, lead advanced transportation analyst at BNEF. “Lithium-ion battery costs have already dropped by 65 percent since 2010, reaching $350 per kWh last year. We expect EV battery costs to be well below $120 per kWh by 2030 and to fall further after that as new chemistries come in.”

“Our central forecast is based on the crude oil price recovering to $50 and then trending back up to $70-a-barrel or higher by 2040,” says Salim Morsy, senior analyst and author of the study. “Interestingly, if the oil price were to fall to $20 and stick there, this would only delay mass adoption of EVs to the early 2030s.”

Although some 1.3 million EVs have now been sold worldwide and 2015 saw strong growth, they still represented less than 1% of light-duty vehicle sales last year.