Clean Energy Fuels Corp. has announced its operating results for the fourth quarter of 2018 and year ended Dec. 31, 2018.

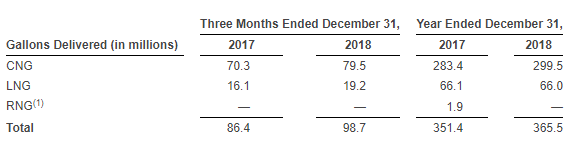

The company delivered 98.7 million gallons of natural gas in the fourth quarter, representing a 14.2% increase from the 86.4 million gallons delivered in the fourth quarter of 2017. This increase was due to growth in compressed natural gas (CNG) and liquefied natural gas (LNG) volumes, principally from increased Redeem renewable fuel sales.

For the year ended Dec. 31, the company delivered 365.5 million gallons, representing a 4.0% increase from the 351.4 million gallons delivered for the year prior. This increase was due to growth in CNG volumes, partially offset by a reduction in LNG volumes, resulting from the non-renewal of two contracts and a decrease in renewable natural gas (RNG) volumes for non-vehicle fuel that were included in contracts sold to BP Products North America Inc. in the sale of its upstream RNG production business to BP in March 2017.

The company defines “gallons delivered” as its gallons of RNG, CNG and LNG, along with its gallons associated with providing operations and maintenance services, plus the company’s proportionate share of gallons delivered by joint ventures.

The table below shows gallons delivered for the three months and years ended Dec. 31, 2017, and 2018:

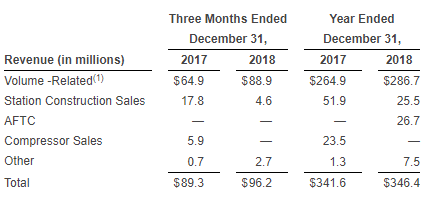

The company’s revenue for the fourth quarter was $96.2 million, compared with $89.3 million for the fourth quarter of 2017. Included in volume-related revenue for the fourth quarter of 2018 was $10.3 million of unrealized gains on commodity swap contracts the company entered into in connection with its Zero Now truck financing program. Station construction revenue was $4.6 million, compared to $17.8 million for the fourth quarter of 2017. Clean Energy notes that revenue for the fourth quarter of 2017 included $5.9 million in compressor sales, whereas in 2018, the company did not record any such sales, due to combining its compressor manufacturing business with Landi Renzo S.p.A’s compressor manufacturing business in December 2017.

Revenue for all of 2018 was $346.4 million, representing a 1.4% increase from $341.6 million in 2017.

The following table represents the company’s sources of revenue for the three months and years ended Dec. 31, 2017, and 2018:

“We’re exiting 2018 with good volume growth and excellent momentum from a successful year,” comments Andrew J. Littlefair, president and CEO of Clean Energy. “Our operating results for 2018 were the best in the past five years, and we finished 2018 with more cash and investments than debt, this after paying down $185.5 million in convertible debt during the year, leaving us with only $50 million of convertible debt due in July 2020.

“We go into 2019 with two of the largest energy companies in the world, Total and BP, as key partners,” he continues. “Total is our largest shareholder and has been instrumental in supporting our exciting Zero Now truck financing program, while during the fourth quarter, we expanded our relationship with BP, allowing us to accelerate and expand the distribution of our Redeem renewable fuel. These are strong relationships, and we’re excited for what the future holds.”