Amid rising predictions of the accelerating adoption of electric vehicles (EVs) across the country, a new report from the Smart Electric Power Alliance (SEPA) finds that many U.S. utilities are still in the earliest stages of EV programs and activities.

Based on a survey of 486 utilities, the report, “Utilities and Electric Vehicles: Evolving to unlock grid value,” found that nearly 75% were either in the early stages of planning for EV market growth or had yet to start developing strategies or programs. The utilities surveyed provide power to about 70% of all residential, commercial and industrial customers in the U.S., notes SEPA.

“Utilities have a key role to play in EV market growth, as providers of ‘fuel’ – electricity – as a platform for charging infrastructure and as a leader in standards development and consumer education,” says Erika Myers, SEPA’s director of research and lead author on the report. “Yet, our research shows that the situation right now is similar to what we saw with the growth of distributed solar. If predictions are correct, many utilities will be caught unprepared, with few ready to take full advantage of this new demand by leveraging EVs as a grid asset.”

Other key findings in the report include as follows:

- Analysts now forecast that EV energy use could rise from a few terawatt-hours (TWh) a year in 2017 to at least 118 TWh and as high as 733 TWh by 2030. These forecasts are the equivalent of the average annual power consumption of 9 million to 68 million U.S. homes, respectively.

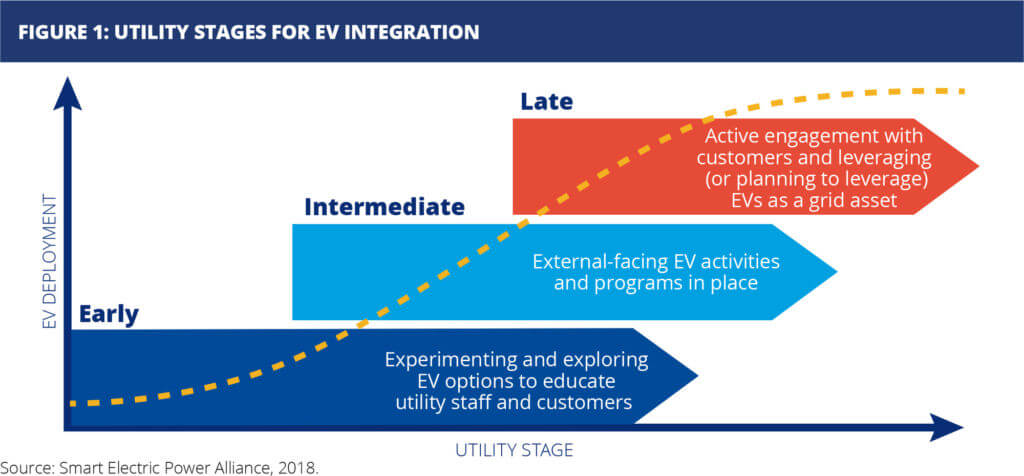

- With the utilities surveyed classified as either in an early, intermediate or late stage of EV program development, only 3% were in the late stage, while 23% were intermediate and 74% were early. (See below.)

- Larger investor-owned utilities were more likely to be in the late stage (often as a result of regulatory or legislative mandates), while municipal utilities and electric cooperatives serving smaller customer bases tended to be classified as intermediate or early.

- Regulatory action related to EVs and charging infrastructure remains dispersed and uneven. Regulatory filings are clustered primarily in states with high numbers of EVs or pro-EV policies and include dockets on utility programs associated with intermediate or late stages. Utility ownership of EV charging systems is a particular point of discussion among regulators.

To promote the development of robust EV strategies, utilities should collaborate with stakeholders across the industry; mitigate and manage grid impacts of EV adoption; and share information and best practices to cut the time and cost of new EV programs, says SEPA.

The report also highlights examples of utility programs across the country, reflecting different stages of EV program development. San Diego Gas & Electric has one of the the highest total number of EV programs and activities accounted for in the research, according to SEPA. The utility’s “Power Your Drive” program allows customers in apartments and condominiums or at businesses to access charging stations that use an EV rate that is based on actual, day-ahead, hourly pricing. Customers can use a phone app to enter their time preferences, giving them the option to save money by charging during the lowest-price hours of the day.

“Utilities and Electric Vehicles: Evolving to unlock grid value” is available for free download here.