The new J.D. Power 2023 U.S. OEM EV App Report finds that although app usage by owners of gasoline-powered vehicles has increased recently, EV owners are still likely to use their apps more often, especially for needs such as viewing active charging status or checking range information.

In fact, nearly two-thirds (66%) of EV owners use their brand’s app at least half of the time they drive, which is indicative of its increasingly important role in the EV ownership experience.

However, the company found that the app features EV owners find most important are among the features that have the lowest level of customer satisfaction.

“Manufacturers need to focus on improving the performance of the areas that matter most to EV owners in order to maximize their impact and elevate the user experience,” says Jason Norton, senior manager of global automotive consulting at J.D. Power.

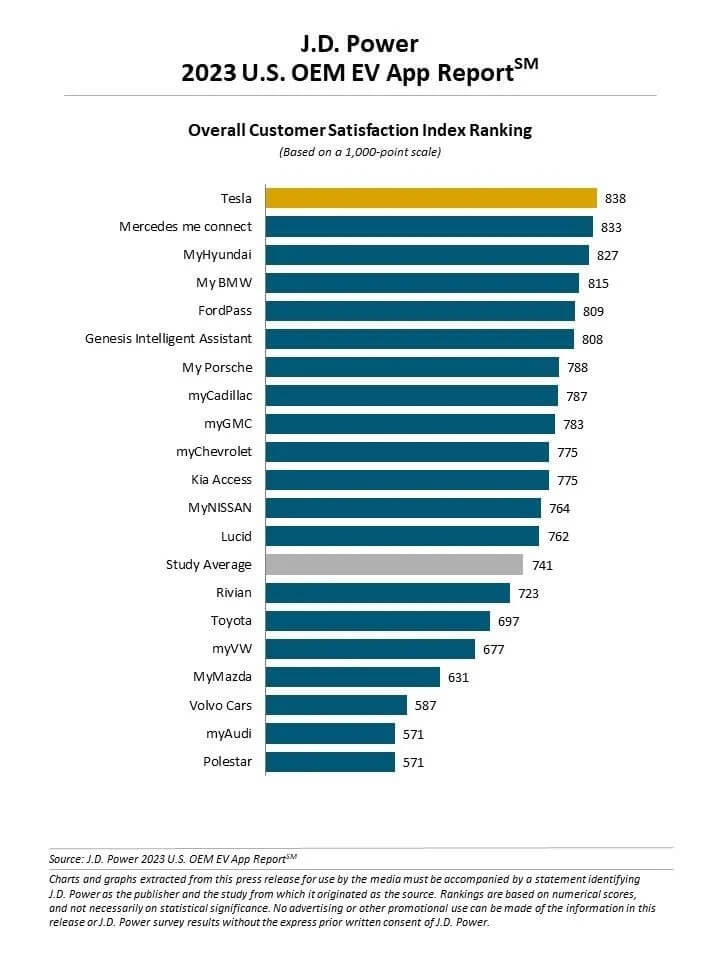

Among manufacturers, Tesla’s mobile app ranks highest, with a score of 838 (on a 1,000-point scale). Mercedes’ me connect (833) ranks second, and MyHyundai (827) ranks third. The report average is 741.

Following are some key findings of this report:

- Speed and ease of navigation are the two most important app usage elements for EV owners, yet these are among the lowest-scoring areas overall. Conversely, an app’s visual appeal is least important to EV owners yet ranks near the top in satisfaction. This suggests manufacturers need to do a better job of focusing on areas that are most critical to app users to provide the most engaging and productive experience.

- More than half (59%) of Tesla owners say the availability of the smartphone app had at least a moderate effect on their decision to purchase, compared with 35% of non-Tesla EV owners. Furthermore, 21% of Tesla owners say it had a major effect vs. just 7% of non-Tesla EV owners. As Tesla owners have often been on the forefront of EV trends, this suggests the industry must do a better job of communicating the availability and effect of their smartphone apps to help attract interested EV shoppers.

- More than two-thirds (68%) of EV owners say that they use their app at least every other drive to monitor the charging process and viewing their available range, which is in line with 2022 results. While owners predominately charge their vehicles at home, 85% say they still desire the ability to find charging stations in case they need one while away from home.

- Of the 25 most common app features, 19 features are cited as desirable by more than 70% of EV owners. However, only eight features are widely available throughout the industry.

- Most owners receive help from the dealer or manufacturer in explaining or setting up their smartphone app. More than eight in 10 (85%) EV owners say they received some sort of assistance, and 90% of premium brand owners (excluding Tesla) say they received dealership support. EV app features need to be explained to owners by dealership personnel, as highlighted by the 25% of owners who say they have never used their EV app because they didn’t know how to do so.

- More than one-third (37%) of EV owners say they had some type of connection-related problem with their app in the past 30 days, up from 32% a year ago. This may suggest that increasing app usage is straining some manufacturers’ app network capacity.

Photo by David von Diemar on Unsplash