If you believe the headlines, we’ve entered the age of electric vehicles (EVs). Tesla is the hottest name in automobiles; the Chevrolet Bolt EV won MotorTrend’s 2017 car of the year award and its sales are booming. Meanwhile, General Motors, Ford, Nissan, Volvo, Porsche, Volkswagen and Audi plan to launch dozens of new EV models in the coming years.

Several factors – including state and federal tax policy and regulations, clean car standards, and car performance, among others – could speed or slow the trend. But one major hurdle can’t be overlooked: Prospective EV purchasers have to feel confident that they can obtain the electricity needed to power their vehicles as easily – and potentially as quickly – as they can now fuel their conventional vehicles.

Looking at the issue from that perspective, a potential, and very practical, solution for such range anxiety becomes clear. Convenience stores – which are often practically synonymous with gasoline stations – exist in every community. Their business model is built on attracting customers by offering quick access to a variety of goods and services, including gasoline and diesel.

On numbers alone, the case for convenience stores is strong. According to a recent study by the Edison Electric Institute and the Institute for Electric Innovation, the number of EVs on the road in the U.S. will increase from 567,000 at the end of 2016 to 7 million by 2025, representing approximately 3% of registered vehicles. To support this deployment, approximately 4.5 million to 5.5 million charging ports will need to be installed by 2025, up from the estimated 100,000 available today. While the majority of these installations will need to be at home and workplace locations, publicly available infrastructure will also be critical.

Speed and ease of EV recharging will be a key issue for both customers and convenience store owners. Direct current (DC) fast charging units, which typically can recharge a vehicle in 30 to 60 minutes, are the equipment most commonly used in pilot or demonstration projects at convenience stores today. Level 2 chargers – often used for workplace or home charging – by contrast can take anywhere from four to six hours.

The trend going forward is for ever-faster charging equipment that allows quick battery top-ups. The next generation of DC fast chargers in development could allow refueling in as little as five to 10 minutes – a far more lucrative prospect for convenience stores that rely on quick customer turnover to maximize sales.

The convenience store industry is well aware of the potential for EV charging – especially given projections of declining gasoline consumption by cars and light trucks in the coming years and the need to cater to a new set of potential customers that don’t require conventional fuel. But so far, we’re seeing more talk than action – and where there’s action, it’s limited.

In the U.K., Shell is currently installing DC fast chargers at 10 locations, and company officials forecast that 20% of their stations’ profits from selling fuel eventually will come from non-petroleum sources. Canadian convenience-store giant Alimentation Couche-Tard, which owns the Circle K and On the Run brands in the U.S., plans to experiment with vehicle chargers in Europe. The company’s efforts may be especially focused on Norway, where government subsidies and infrastructure – such as highway lanes devoted to electric cars – are encouraging EV adoption.

In the U.S., locally owned chains, such as the Spinx Company based in South Carolina, have long supported alternative transportation fuels and appear to be moving in the same direction with EVs. In 2016, Spinx installed seven DC fast chargers in partnership with Nissan’s “No Charge to Charge” program. Others, such as Royal Farms, based in the mid-Atlantic region, have taken advantage of government funds to install at least 15 of their 21 DC fast chargers, in partnership with an equipment manufacturer, ChargePoint, and local electric utilities.

Slow Action in the U.S.

These examples are exceptions to the rule. The vast majority of U.S. convenience stores seem to be waiting for EV adoption to accelerate before making the leap. The result is a chicken-and-egg problem – balancing short-term barriers and longer-term opportunities – that could slow the growth of EVs beyond the early-adopter demographic.

On the barrier side of the equation, convenience store owners see a number of challenges:

- Bad rate of return. Many convenience stores have thin profit margins and lack the capital for up-front investments that may pay off only over the long term. EV volume remains low, so for the foreseeable future, the number of customers attracted to convenience stores by chargers may not seem worth the cost, which can start at $100,000 or higher per charger. Other impacts could include fewer parking spaces for other customers or, in most cases, the need to upgrade electric service level from single- phase to three-phase 480 volt service. Further, increased electricity consumption due to EV charging could mean higher electric bills, including potential demand charges, with resulting impacts on stores’ bottom lines.

- Policy barriers. In some states, reselling electricity is illegal; in others, local zoning or building code regulations for installing charging equipment have not yet been adopted.

- Conflicts with retail model. While some convenience stores are co-located with sit-down restaurants or cafes, many others lack a seating area where customers can wait for 30 minutes while their cars charge.

- Uncertainty about technology. While the EV industry has adopted standard charging levels, it has two different standards for connectors, the component that plugs into the car. Convenience store owners may be uncertain which of the two to install: SAE J1772 Combo and CHAdeMO. Proprietary charging equipment may complicate the choice further; for example, Tesla has its own superchargers with connectors that don’t work on non-Tesla cars. Further, no best practices currently exist for how to “future proof” an installation so it can upgrade to even faster charging options that may become commonplace in a few years.

What’s needed to overcome these barriers is a conversation between suppliers of electricity – electric utilities – and convenience store owners to lay the groundwork for pilot projects that install EV chargers in or near convenience store parking areas.

Such partnerships could work in several ways. Under one hypothetical option, utilities could provide capital and technical expertise to install fast chargers, with some kind of on-bill financing to help convenience store owners pay for the equipment. The offset for the convenience store owner could be the potential for increased revenue sales of food, beverages and other products to EV drivers.

As utilities shift to new business models to better capture the value of distributed energy resources, including EVs, convenience stores could provide a ready platform for optimizing benefits from EVs and EV charging equipment. In addition to direct electricity sales to EV drivers, partnerships with convenience stores could also allow for the introduction of dynamic pricing for EV charging. That is, prices could change in real time to reflect changing grid conditions and system prices – as retailers do already for gasoline prices to respond to real-time market conditions, competitors, and world events.

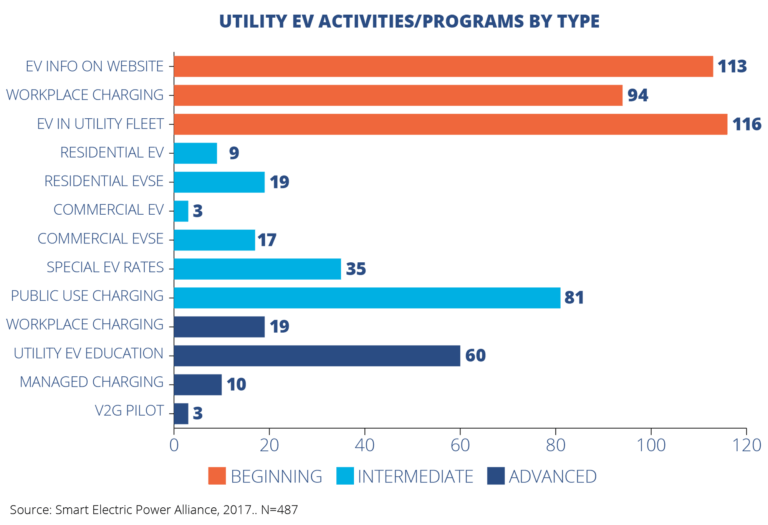

Utilities have already begun to experiment with a number of EV programs, including charging infrastructure incentive programs (e.g., rebates, discounts), workplace charging infrastructure programs, time-of-use rates and other activities to support market growth. According to a recent survey of nearly 500 utilities, the Smart Electric Power Alliance (SEPA) identified 81 that had programs supporting public-use charging infrastructure, as shown in the figure below.

The Case for Utility-Convenience Store Collaboration

It is also important to remember that gasoline stations didn’t crop up by themselves. They were created in the early 20th century by oil refiners looking to increase automobile and gasoline sales. Similarly, utilities may need to take the lead in spurring demand for EVs by investing in the charging infrastructure needed to support adoption.

Assuming that the convenience store model for EV charging becomes widely adopted, existing gasoline stations could be an essential part of any large-scale infrastructure deployment effort. A roll-out that will save costs and maximize positive infrastructure impact – for both sides – means electric utilities and convenience store owners should be working together now. The selling points for such collaborations include the following:

- Convenience stores have highly visibly, well-traveled locations. Convenience stores are located at well-traveled intersections or other easy-to-reach sites for vehicle refueling, and these businesses already have local name-brand recognition. Customers are used to seeing the stores and stations, or have pulled in either to fill up their conventional vehicles or buy a snack.

- Convenience stores – especially large rest stops – are already high energy users. Certain convenience stores, such as large travel stops along interstates, already have three-phase service to support their higher power loads (e.g., from commercial refrigeration units). With proper planning, adding EV chargers at such locations could be relatively easy compared to sites without that level of electric infrastructure. In addition, utilities could identify prime convenience store locations for fast chargers, based on available distribution capacity.

- Convenience store locations have ready-made amenities. Access to existing restrooms and food will make the time waiting for an EV to charge more comfortable for consumers and therefore increase the likelihood that customers will stop to use a charging station.

- Utilities could provide additional revenue streams, improving the business case. Because it is difficult to make money reselling electricity, convenience stores already have an upper hand compared to traditional charging spots, as they also have revenue from non-fuel sales, such as food, drinks and ice. While adding hundreds of thousands of dollars in new equipment to a convenience store location may be financially challenging, these established revenue streams may help these locations recover their investments more quickly. Additional revenue could come from capacity or ancillary services provided by managed charging or vehicle-to-grid activities.

- Convenience store owners are experts at marketing and advertising. Having more chargers available at existing fueling locations will provide additional visibility – and familiarity – to a large set of potential EV buyers. Marketing tactics, such as including real-time charging prices on roadside billboards, could provide even greater visibility.

Who will or should own EV charging infrastructure – and the very valuable data these machines produce – remains a point of ongoing discussion across the utility, auto, charging equipment, and tech industries. Shell recently acquired New Motion, a charging firm with 30,000 EV chargers in Europe, showing some sense of the direction of the convenience store of the future.

SEPA’s EV Working Group is exploring a range of solutions for expanding EV charging infrastructure and the many complex issues EV market growth poses. More information on the member-only working group, including how to join, is available here.

Both co-authors work at the Smart Electric Power Alliance, where Ken Doyle is chief operating officer and Erika Myers is director of research. This article, originally published on the organization’s website, was adapted and reposted with permission from SEPA.

Photo courtesy of ChargePoint: A DC Fast Charger in front of a Royal Farms convenience store.